There is a lot of information online on how to buy Telos (TLOS). But how do you withdraw and turn it into Fiat? Especially when you use one of the big exchanges = Binance? Coincheckup makes it easy in this article.

There is a lot of information online on how to buy Telos (TLOS). But how do you withdraw and turn it into Fiat? Especially when you use one of the big exchanges = Binance? Coincheckup makes it easy in this article.Binance is the largest cryptocurrency exchange in terms of trading volume by a large margin. It provides a wide range of crypto investment products and services, allowing users to generate passive income on their digital assets and engage in countless spot and derivative markets.

If you are an avid cryptocurrency trader or just a casual “buy and hold” type investor, sooner or later you are faced with the decision of turning your crypto profits into fiat to cash out your funds. In this article, we will examine different ways of withdrawing fiat from your Binance account and help you pick the method that best fits your particular sets of needs.

Selling your cryptocurrency for fiat

The first thing you need to do in order to get funds from your Binance account is to exchange your digital assets for fiat. You can do so in a variety of ways. For example, you can do so by selling crypto in spot markets for fiat or buying fiat with crypto by navigating to appropriate trading pairs.

Suppose you intend to sell a large amount of digital assets but find yourself hesitant to pull the trigger due to the difficulty of identifying a good selling opportunity. In that case, you can employ a dollar-cost averaging (DCA) strategy. While DCA is typically used when buying assets, it can be an excellent choice to exit your position as well.

Binance Recurring Buy – A Simple Way to Invest in Bitcoin on Monthly Basis

While there is currently no automated service available on Binance to set up recurring sell orders, you can easily formulate your own plan and execute the strategy. It is worth noting that on the selling side, it is best to tweak the DCA strategy a bit and focus on selling the same amount of assets in predetermined intervals instead of withdrawing the same amount of fiat. This is because an investor must sell a larger number of assets when the market is low and fewer when it is high, which leads to a low average price, which is not the desired outcome.

How to sell your crypto for fiat

Note that you need to be a registered user in order to have full access to Binance’s suite of withdrawal services and enjoy higher transaction limits. As of October 19, all Binance users are required to complete the KYC procedure.

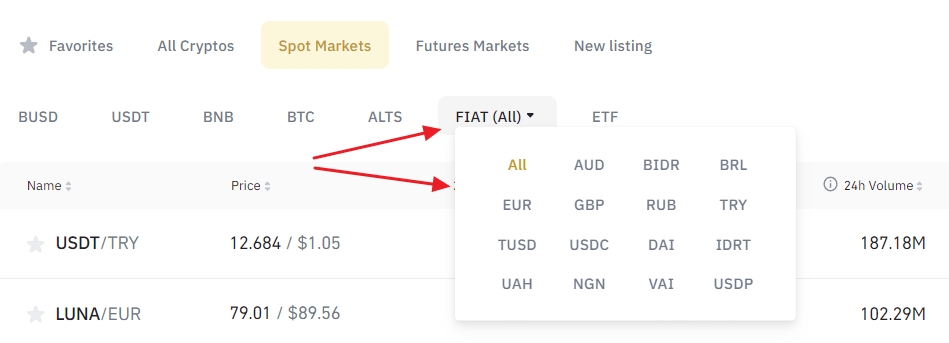

Step 1 – Navigate to the “Markets” section on the Binance homepage and select crypto/fiat trading pair, such as BTC/EUR, for instance.

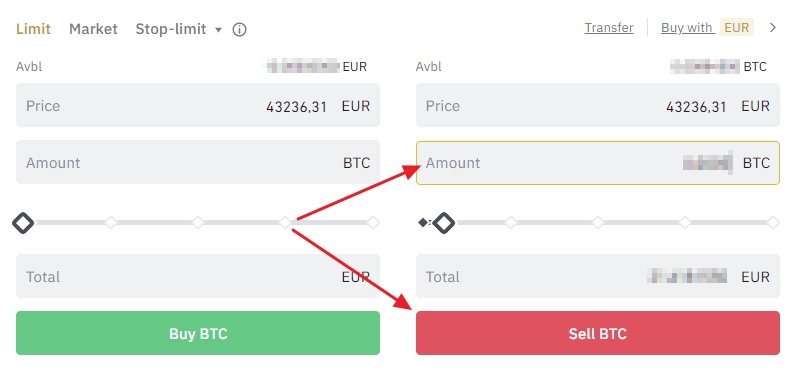

Step 2 – Once in the trading view, enter the amount of crypto you would like to exchange for fiat funds. In our example, we are selling Bitcoin for EUR.

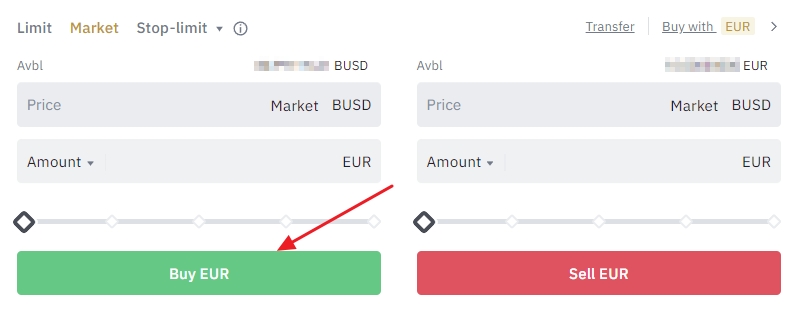

Alternatively, you can select a fiat/crypto trading pair, such as EUR/BUSD, and buy fiat with crypto.

Now that you’ve obtained fiat, you can proceed to the next step of withdrawing your funds via the bank account withdrawal method or by credit/debit card. You can also use third-party channels if those options are available for your particular fiat currency selection. Keep in mind that available withdrawal methods will depend on your country of residence and the fiat currency you decide to use.

Withdrawal methods vary between different fiat currencies

Binance supports a wide range of fiat options, including the most popular currencies such as USD, EUR, and GBP. Keep in mind that the list of supported currencies is subject to change, as is the list of countries whose residents are eligible to make fiat withdrawals on Binance.

Additionally, certain withdrawal methods and third-party channels are not available to all Binance users as they can be accessed only from certain territories and on a per currency basis.

A step by step guide on how to withdraw fiat from Binance

In this section, we will explain the main differences between various withdrawal methods and guide you through the process of using bank transfers, debit/credit cards, and third-party channels.

Withdraw via bank transfer (USD SWIFT)

SWIFT is one of the most widespread cross-border payment networks in the world. It serves as an intermediary and executor of transactions between banks internationally and is linked to over 11,000 financial institutions in more than 200 countries.

Binance charges a 15 USD flat fee on SWIFT withdrawals. Note that if your bank account doesn’t support USD natively, you may incur additional currency conversion fees upon receiving funds from Binance.

Here’s the complete guide showing how to use the bank transfer (USD SWIFT) withdrawal method.

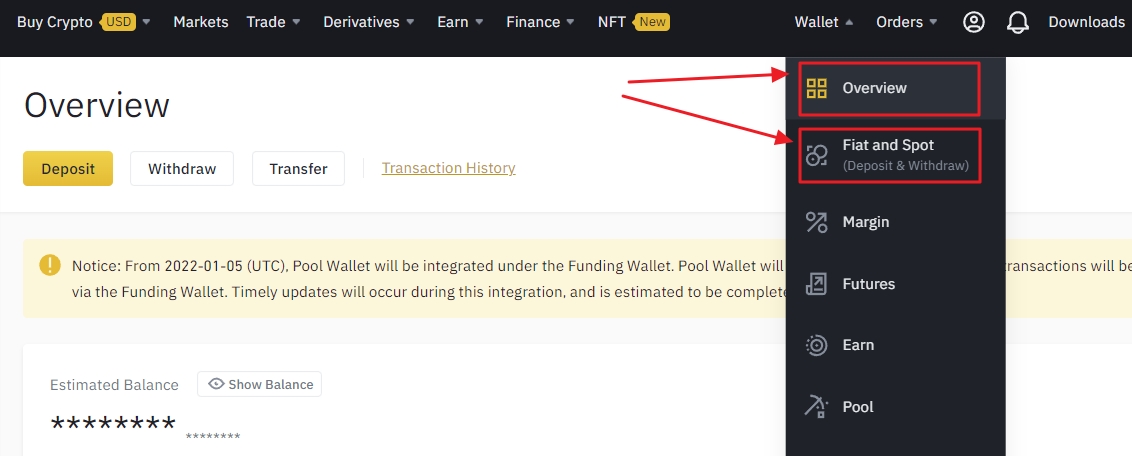

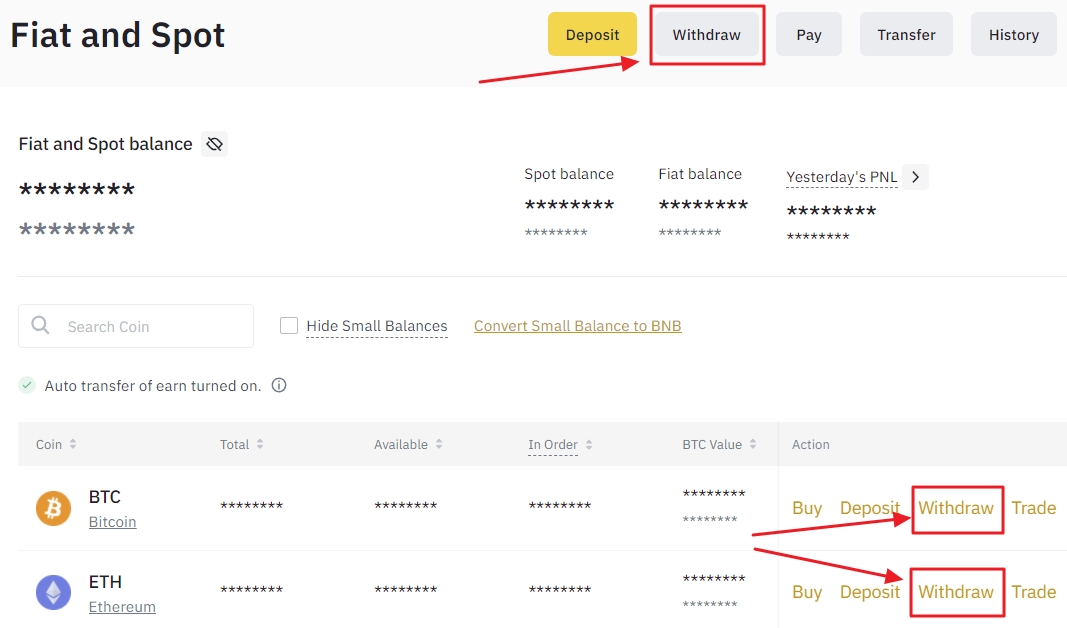

Step 1 – Binance provides several different ways of requesting fiat withdrawals. From the “Wallet” drop-down menu on the Binance homepage, you can select either “Overview” or “Fiat and Spot” options, whichever you prefer. Admittedly, going the Fiat and Spot route is a bit faster since it requires a couple of clicks less to reach the Withdrawal form.

Step 2 – Click on the “Withdraw” button at the top of the Fiat and Spot section or request a withdrawal from the list of coins section.

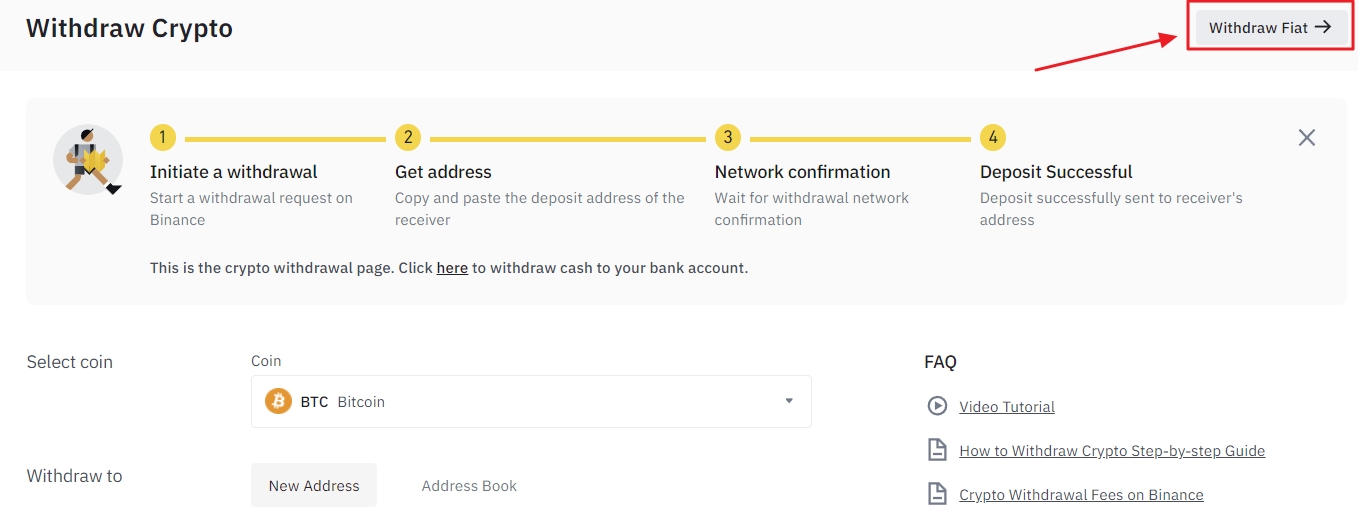

Binance occasionally initiates the crypto withdrawal process upon clicking on the Withdraw button. Click on the “Withdraw Fiat” button in the upper right corner to proceed with the fiat option.

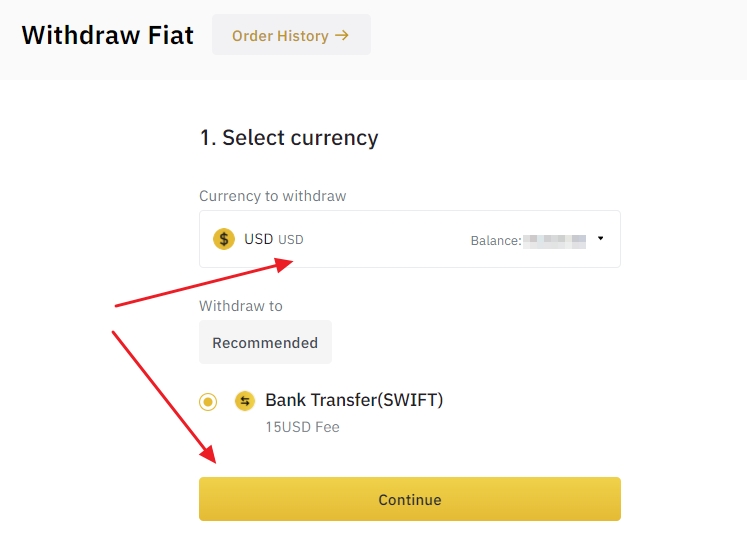

Step 3 – Select the currency you wish to withdraw. When selecting USD as a withdrawal currency, the “Bank Transfer (SWIFT)” is the only option available.

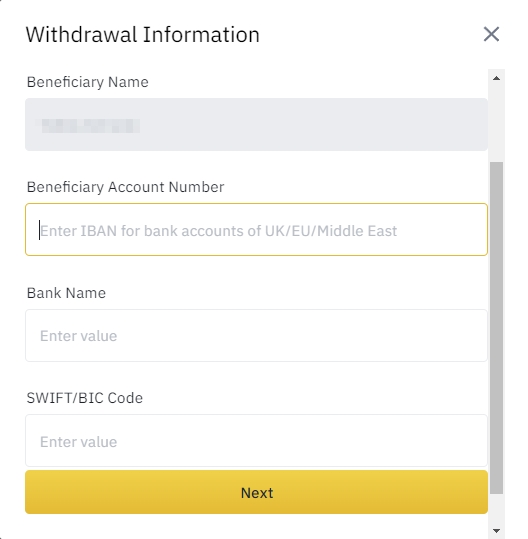

Step 4 – Enter the information about the financial institution you are transferring the funds to, such as bank name and SWIFT/BIC code. Complete the two-step form with relevant details and click “Next” on the bottom of the popup.

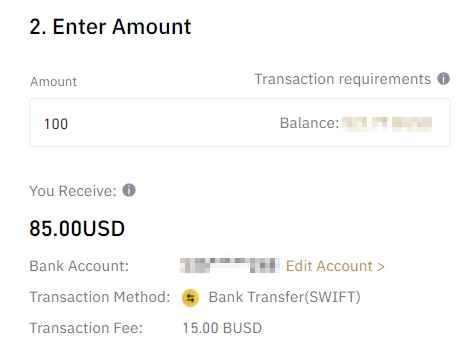

Step 5 – Enter the amount of USD you would like to withdraw. As you can see from our examples, there is a 15 USD withdrawal fee on every withdrawal, no matter the amount.

Step 6 – Click “Confirm” to execute a SWIFT money transfer.

SWIFT-powered transactions usually take between 2 and 4 business days. If more than four days have passed since you’ve requested a withdrawal via SWIFT and you still haven’t received your funds, Binance advises that you proceed by contacting the financial institution you’ve selected during the process.

SWIFT transfers are most commonly used for larger withdrawals due to their flat fee structure. The maximum withdrawal limit is directly correlated to your particular account verification level. As a side note, SEPA bank transfers, a Eurozone equivalent of the international SWIFT money transactions, have been temporarily suspended in July 2021.

Pros of the bank transfer (USD SWIFT) withdrawal method:

- Flat fee structure favors larger withdrawals

- Supports high transaction amounts (KYC’ed users can withdraw up to $200K daily)

Cons of the bank transfer (USD SWIFT) withdrawal method:

- Relatively long cash out times

- Transactions are not processed on weekends

Withdraw via debit/credit card

Debit and credit cards can be an excellent choice to withdraw money, especially if you need quick access to your funds. In contrast to the flat fee structure of SWIFT transfers, Binance charges a percentage fee on each debit/credit card withdrawal.

If you lack fiat funds in your Binance account, follow steps 1 through 3 from the SWIFT withdrawal section. Otherwise, proceed with the following steps.

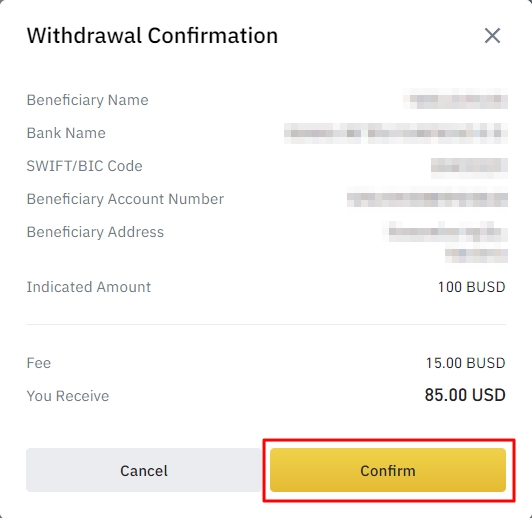

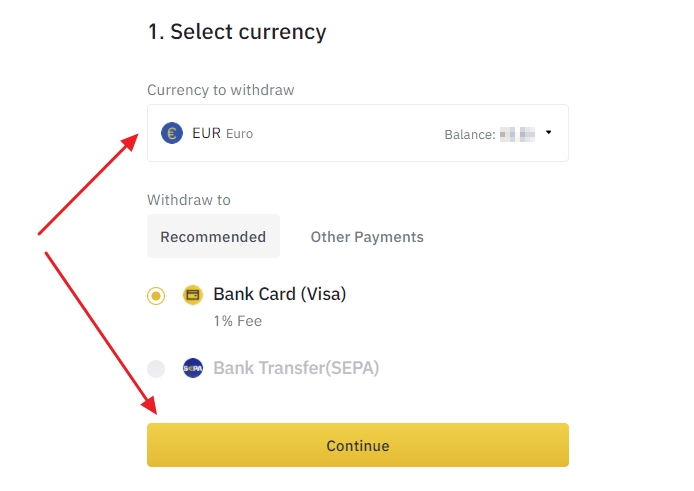

Step 1 – Select currency and the “Bank Card” option and proceed to the next step by clicking “Continue”.

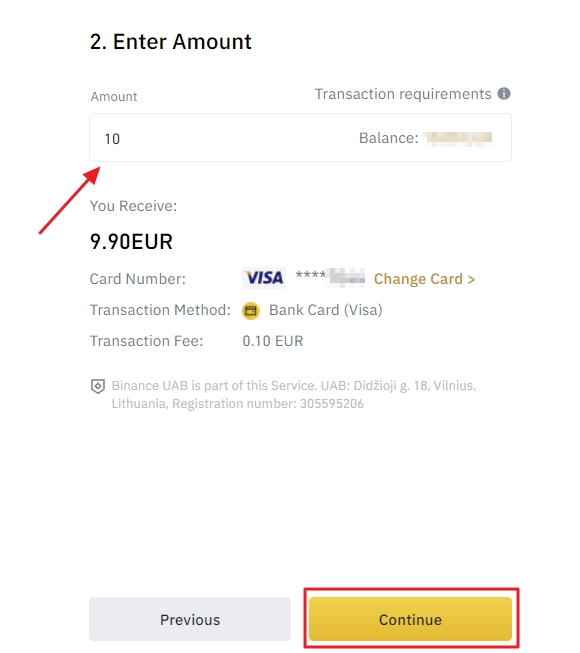

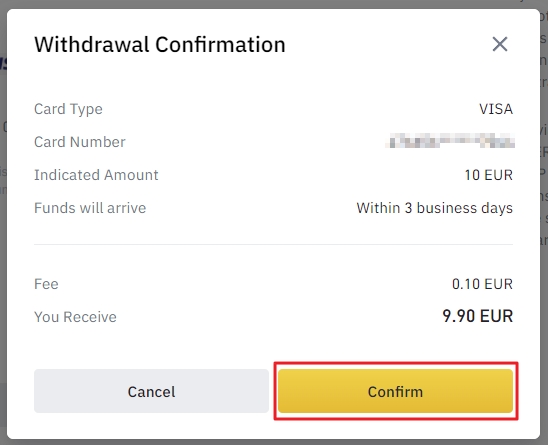

Step 2 – Enter your withdrawal amount and pick the credit card you would lite to use. The fixed percentage transaction fee is immediately accounted for.

Step 3 – A withdrawal confirmation prompt will appear. Click the “Confirm” to finalize the withdrawal process.

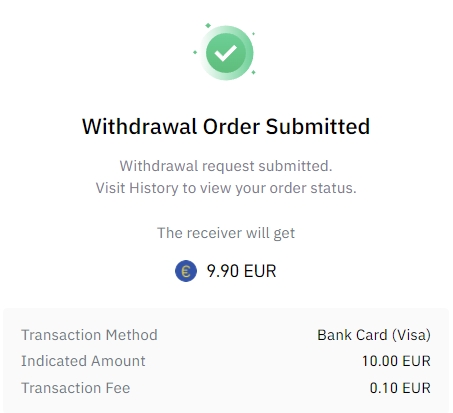

Step 4 – A notification message greets you, summarizing the withdrawal order.

Payment card transactions are usually executed swiftly. You cant expect money from Binance to be transferred within a couple of minutes, and at most within 24 hours.

At the time of writing, Binance supports Visa card withdrawals for EUR, GBP, and RUB local currencies. Here’s a list of countries whose residents are eligible to request direct EUR and GBP Visa payment card withdrawals.

Pros of the debit/credit card withdrawal method:

- Fast transaction times, funds are usually cashed out within 5 minutes

- Fixed percentage fee structure benefits smaller transaction amounts

Cons of the debit/credit card withdrawal method:

- Larger withdrawals are not supported (limited to 5000 EUR/4500 GBP)

Withdrawal via third party channels

Binance supports a wide range of third-party channels that allow users to withdraw money from their accounts even if the direct bank transfer or credit and debit card options are not available. Some examples of the third-party payment processors currently supported by Binance include Advcash and Payeer.

The process of withdrawing funds via third-party channels is similar to the above-described bank transfer and credit card methods. The main difference is that the withdrawal will be completed with a third-party company.

Keep in mind that while the fee structure of 3rd party companies is usually very competitive, transaction costs can vary depending on the local currency you’ve picked.

Pros of the third party channels withdrawal method:

- Low fees and fast transactions times

- Transactions take less time to clear than when using bank transfers

Cons of the third party channels withdrawal method:

- Limited to specific regions and local currencies

- The transaction fee structure can vary depending on the fiat option

Transfer crypto to another exchange and withdraw from there

Binance provides a great variety of withdrawal methods and supports a long list of fiat currencies. However, suppose Binance does not support your particular local currency. In that case, you can easily transfer your digital assets to another exchange, where you can convert your crypto to fiat and withdraw the freshly converted funds.

In the guides below, you will find a step-by-step tutorial on how to send Bitcoin from Binance to two popular crypto exchanges:

The process is similar between most major centralized exchanges. Make sure to enter the correct information when transferring crypto, as incorrect details can lead to a permanent loss of funds.

Use the withdrawal method that best suits your needs

There are significant differences when withdrawing funds from your Binance account in terms of fee structure and transactions times depending on the fiat currency you choose and your country of residence. Make sure to weigh your options before making a withdrawal and use the best method for you.

In general, bank transfers are an excellent choice when making larger withdrawals, and time is not of the essence. Credit and debit cards are better suited for quick withdrawals; however, costs can quickly surpass those of bank transfers due to a fixed percentage fee structure.

Over the years, Binance has streamlined the fiat withdrawal process and made it as straightforward and transparent as possible. Turning crypto profits into fiat has never been easier.

DISCLAIMER: Although the material contained in this website was prepared based on information from public and private sources that telosfly.com believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and telosfly.com expressly disclaims any liability for the accuracy and completeness of the information contained in this website.